Finding the right way to borrow money can feel overwhelming, especially when unexpected expenses arise or you’re planning a major purchase. This guide will walk you through the 10 best borrowing options tailored for different needs. Whether you’re dealing with medical emergencies, home improvements, or debt consolidation, understanding your options will help you make smarter […]

Monthly Archives: January 2025

Disasters strike when least expected, leaving individuals and families struggling to recover from the financial burdens they bring. Recognizing the challenges faced by Filipinos during natural calamities, the Social Security System (SSS) offers the Calamity Loan Program—a financial assistance package designed to provide a lifeline in times of crisis. As we approach , it’s crucial […]

The digital revolution has reshaped the financial landscape globally, and the Philippines is no exception. Online lending platforms, powered by financial technology (fintech), have emerged as a practical solution for individuals and businesses seeking fast and accessible financial services. However, as the industry grows, ensuring safety and legitimacy becomes more critical than ever. In the […]

Ayuda Philippines has emerged as a transformative platform, bridging the gap between individuals in need and generous donors, non-governmental organizations (NGOs), and government assistance programs. With its growing popularity comes a critical question: is Ayuda Philippines legal and trustworthy? This in-depth review delves into its operations, compliance with legal standards, and the user experience in […]

As digital finance transforms the way people access financial services, Tala has emerged as a game-changer, especially in the Philippines. With millions still unbanked or underserved by traditional financial systems, Tala provides a lifeline for individuals needing small, short-term loans. However, one pressing question often arises: Is Tala legal in the Philippines? 💥 Online Legit […]

Digital lending platforms have revolutionized how people access financial assistance, particularly in regions like the Philippines where traditional banking services may not reach everyone. Among these platforms, FINLOO stands out for its user-friendly approach and quick loan disbursement. However, as these services grow, the question arises: Is FINLOO legal? 🔥 FINLOO Online Loans Philippines 👉 […]

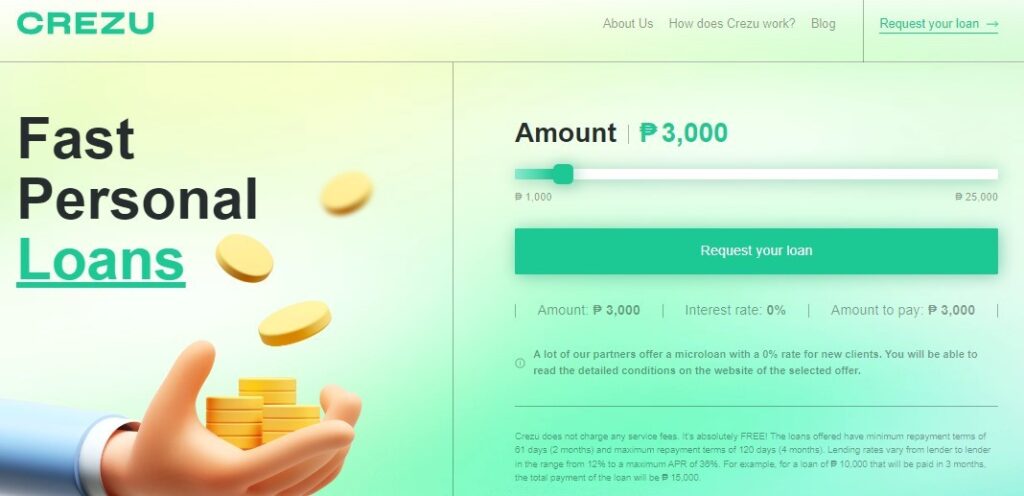

Navigating the financial landscape in the Philippines can be overwhelming, especially when you need quick, reliable credit. Enter Crezu, a growing name in the world of online lending. Promising a seamless borrowing experience with fast approvals and transparent costs, Crezu has captured the attention of many. But is Crezu a legitimate option, or should borrowers […]

Unexpected financial needs can catch anyone off guard—whether it’s for a medical emergency, tuition fees, or urgent repairs. If you’re in the Philippines and need to borrow money quickly, you have a wide range of options, each with its own advantages, requirements, and considerations. Here’s a detailed guide to help you navigate your choices efficiently. […]

In an era where digital financial solutions are reshaping the Philippine lending landscape, FinmerKado has emerged as a notable player in the online lending space. This comprehensive review examines FinmerKado’s legitimacy, features, and performance in , helping you make an informed decision about this digital lending platform. 🔥 FINMERKADO Loan App Philippines: 👉 Quick Loan […]

🔥 PeroLoan Philippines: 💲 Get a loan in as little as 5 minutes 💲 Low-interest rates 💲 Borrow up to ₱25,000 💲 Fast approval and instant fund transfer! 💯💲 Apply Now! 💲 In recent years, online lending platforms have surged in popularity across the Philippines, offering fast and convenient access to funds for Filipinos in […]