When it comes to borrowing money, understanding the key differences between secured and unsecured loans is essential. Both loan types serve various financial purposes, but each has its unique features, advantages, and drawbacks that can impact your financial well-being. This comprehensive guide delves deep into the world of secured and unsecured loans, offering valuable insights […]

Monthly Archives: April 2025

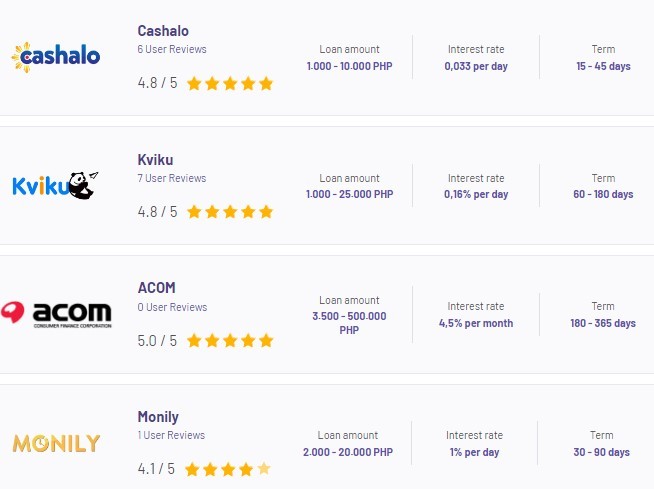

The rise of fintech apps in the Philippines has transformed the way Filipinos access financial services. Borrowing money, once a time-consuming process filled with paperwork, is now just a few taps away. Whether you’re seeking funds for a business venture, emergency expenses, or personal needs, loan apps offer a convenient and fast solution. In this […]

Finding a reliable loan app that offers favorable terms can be challenging, especially for first-time borrowers. However, several online platforms in the Philippines provide 0% interest on initial loans, simplifying the borrowing process and helping you meet your financial needs responsibly. Here’s an in-depth look at the top 10 legitimate online loan apps, their features, […]

With the growing demand for digital convenience, financial institutions have revolutionized how they deliver services to customers. The Bank of the Philippine Islands (BPI), a pioneer in Philippine banking, has joined this trend with its innovative BPI Loan App. This app simplifies loan applications, offering a streamlined digital experience for individuals and businesses alike. However, […]

As digital lending platforms gain popularity in the Philippines, the Atome loan app has emerged as a notable player for quick and accessible credit. However, many potential users ask critical questions: Is Atome legal? How does it work? And, most importantly, is it trustworthy? This detailed review covers Atome’s operations, legal standing, features, pros and […]

Finding the right way to borrow money can feel overwhelming, especially when unexpected expenses arise or you’re planning a major purchase. This guide will walk you through the 10 best borrowing options tailored for different needs. Whether you’re dealing with medical emergencies, home improvements, or debt consolidation, understanding your options will help you make smarter […]

Disasters strike when least expected, leaving individuals and families struggling to recover from the financial burdens they bring. Recognizing the challenges faced by Filipinos during natural calamities, the Social Security System (SSS) offers the Calamity Loan Program—a financial assistance package designed to provide a lifeline in times of crisis. As we approach , it’s crucial […]

The digital revolution has reshaped the financial landscape globally, and the Philippines is no exception. Online lending platforms, powered by financial technology (fintech), have emerged as a practical solution for individuals and businesses seeking fast and accessible financial services. However, as the industry grows, ensuring safety and legitimacy becomes more critical than ever. In the […]

Ayuda Philippines has emerged as a transformative platform, bridging the gap between individuals in need and generous donors, non-governmental organizations (NGOs), and government assistance programs. With its growing popularity comes a critical question: is Ayuda Philippines legal and trustworthy? This in-depth review delves into its operations, compliance with legal standards, and the user experience in […]

As digital finance transforms the way people access financial services, Tala has emerged as a game-changer, especially in the Philippines. With millions still unbanked or underserved by traditional financial systems, Tala provides a lifeline for individuals needing small, short-term loans. However, one pressing question often arises: Is Tala legal in the Philippines? 💥 Online Legit […]

- 1

- 2