As the digital finance landscape continues to expand, Filipino investors are looking for platforms that provide reliable access to global financial markets. One such platform, FINBRO, has quickly gained attention in the Philippines. But as we step into 2025, is FINBRO a legitimate and trustworthy option for Filipino investors? In this comprehensive review, we’ll dive deep into FINBRO’s features, regulatory status, user feedback, and potential risks, allowing you to make a well-informed decision about your investment journey.

See more:

🔥 Top Online Loan Platforms in the Philippines:

👉 DIGIDO ✔ CASH-EXPRESS ✔ KVIKU ✔ FINBRO ✔ CREZU ✔ LOANONLINE ✔ CASHSPACE ✔ FINMERKADO ✔ PEROLOAN ✔ MONEY CAT ✔ FINLOO

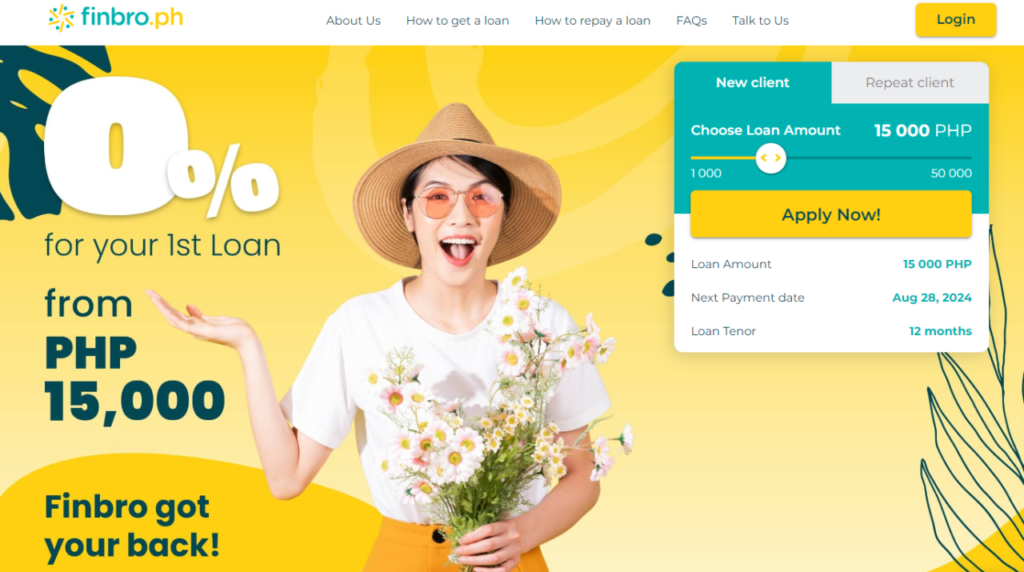

🔥 FINBRO App: Your 100% Online Loan Solution in the Philippines 👉 Simple, fast, and transparent procedures 👉 24/7 availability for loan applications 👉 Approvals within 24 hours 👉 Quick disbursement in just 5 minutes 🔥 Get Started Now: FINBRO Philippines Online Loans 💲

What is FINBRO Philippines?

FINBRO Philippines is an emerging platform that aims to provide Filipino investors with easy access to global financial markets. Designed for both beginners and experienced investors, the platform serves as a comprehensive solution for diversifying portfolios and growing wealth. By offering a digital-first experience, FINBRO ensures that users can trade and invest from anywhere at any time, appealing to the modern investor who values convenience and flexibility.

Accessibility & User Experience

FINBRO shines in its user-friendly design. Whether you’re a seasoned trader or a first-time investor, the platform’s interface is intuitive, making it easy to navigate through various investment options. The platform’s complete online operation means that users can manage their accounts and investments from their homes or on the go, aligning with the needs of today’s digital-savvy investor.

Global Investment Opportunities

FINBRO provides access to a diverse range of global markets, including stocks, bonds, forex, commodities, and cryptocurrencies. This breadth of investment options gives users the chance to diversify their portfolios and tap into international trends. With a variety of asset classes at your disposal, FINBRO positions itself as a platform where investors can explore multiple financial strategies and growth opportunities.

Transparency & Support

Transparency is a key feature of FINBRO. The platform provides real-time market data and insights, ensuring that users can make informed investment decisions. Moreover, FINBRO offers responsive customer support to assist users with any issues or questions they may have, enhancing the overall user experience.

Features & Services of FINBRO Philippines

To understand whether FINBRO meets your investment needs, let’s explore its features and services in more detail.

Tailored Investment Accounts

FINBRO offers a variety of account types, including individual, joint, and corporate accounts. This flexibility allows you to select the account type that aligns best with your financial goals, whether for personal investing or managing company funds. Each account type offers unique benefits, providing a personalized experience for investors of all backgrounds.

Diverse Trading Instruments

One of the standout features of FINBRO is its wide range of trading instruments. The platform allows you to invest in stocks, fixed income, forex, commodities, and even digital currencies. This variety enables you to create a balanced portfolio that can withstand market fluctuations and take advantage of diverse market opportunities.

Educational Resources & Tools

For new investors, FINBRO provides a wealth of educational resources, including webinars, tutorials, and articles. These materials are designed to help users understand investment strategies and risk management techniques, empowering them to make informed and confident investment decisions.

FINBRO Philippines: Regulatory Status & Security Measures

When choosing an online investment platform, ensuring that the platform is regulated and secure is paramount.

Regulatory Framework

While FINBRO claims to operate under a regulatory framework that protects investors, it’s important to conduct further research to verify the specifics of this regulation. Check whether the platform complies with the regulatory standards of local authorities and whether it adheres to industry norms to ensure your funds are safe.

Security Measures

FINBRO prioritizes the security of user data and investments. The platform employs encryption and two-factor authentication to protect personal and financial information. However, as with any online platform, users should remain cautious and take additional measures, such as using strong passwords and monitoring for any suspicious activities.

User Reviews & Experiences with FINBRO Philippines

User feedback is often the best way to gauge the reliability and effectiveness of any platform. Let’s take a closer look at what actual users are saying about FINBRO.

Positive Feedback

Many users appreciate FINBRO’s intuitive platform, especially beginners who find it easy to navigate. The fast and reliable execution of trades, along with responsive customer support, has contributed to high satisfaction among users. Additionally, the platform’s educational resources have helped many investors improve their strategies and achieve better results.

Negative Concerns

On the flip side, some users have expressed frustration with slow withdrawal processing times. Delays in accessing funds could be a concern for users who want to quickly liquidate their investments. Additionally, some traders have noted that the research tools provided by FINBRO are basic, and more advanced tools would benefit those seeking deeper insights into market trends.

Comparing FINBRO to Other Investment Platforms

When evaluating FINBRO, it’s useful to compare it against other popular platforms in the Philippines to assess whether it meets your needs.

Fees & Charges

FINBRO has a fee structure that includes trading fees, deposit/withdrawal fees, and inactivity fees. It’s essential to understand these costs upfront, as they can affect your overall returns. Comparing FINBRO’s fees with other platforms can help determine if it offers competitive pricing.

Range of Trading Instruments

Unlike some platforms that focus solely on stocks or forex, FINBRO offers a broad spectrum of investment options, including commodities and cryptocurrencies. This makes it a versatile choice for investors who want to explore multiple asset classes.

Customer Support Quality

The quality of customer support is a critical factor. FINBRO’s responsive support team is often praised, but it’s worth noting that other platforms might offer even more comprehensive customer service, depending on your needs.

Risks to Consider with FINBRO Philippines

As with any investment platform, FINBRO carries certain risks that investors should be aware of.

Market Volatility

Investing in financial markets comes with inherent risks, especially in volatile markets like forex and cryptocurrencies. Investors should be prepared for fluctuations in their portfolio value and ensure they have a risk management strategy in place.

Platform Security Vulnerabilities

While FINBRO employs security measures to protect user information, no platform is completely immune to cyber threats. Users should remain vigilant and take steps to safeguard their accounts.

Regulatory Changes

Changes in regulations could impact how FINBRO operates. Staying informed about regulatory developments is essential to ensure the platform remains compliant with local laws and regulations.

How to Get Started with FINBRO Philippines

Getting started with FINBRO is simple and straightforward.

- Visit the Official Website – Explore the platform’s offerings and understand the registration process.

- Create an Account – Provide personal and financial details to register.

- Verify Your Identity – Complete the KYC process to ensure a secure environment.

- Deposit Funds – Choose a payment method and deposit funds to start trading.

- Start Trading – Begin exploring the available investment options and develop your strategy.

FINBRO Philippines Fees: What to Expect

It’s important to understand the fees and charges associated with FINBRO before committing funds.

- Trading Fees – Fees for executing buy and sell orders.

- Deposit/Withdrawal Fees – Charges for funding your account and withdrawing funds.

- Inactivity Fees – Fees for accounts that remain inactive for an extended period.

Final Verdict: Is FINBRO Philippines Legit and Reliable?

Based on the features, user feedback, and regulatory considerations, FINBRO Philippines presents itself as a legitimate platform with promising features, especially for those looking to access global markets. However, potential investors should carefully assess the risks involved, especially regarding withdrawal times and limited research tools. A thorough understanding of the platform’s fees, security, and regulatory standing is essential before making any commitments.

In conclusion, while FINBRO Philippines offers a solid foundation for online investment, users should conduct due diligence, stay informed, and adopt a cautious approach before diving into online trading.

🌟 Top 10 Legit Loan Apps in the Philippines for 2025 🌟 1️⃣ Simple Application Process 2️⃣ 100% Online Transactions 3️⃣ Approval Within 24 Hours 4️⃣ Transparent Fees and Charges 5️⃣ Funds Disbursed in Just 5 Minutes 💰💰 Apply Now using the link below! 👇👇👇