Navigating the financial landscape in the Philippines can be overwhelming, especially when you need quick, reliable credit. Enter Crezu, a growing name in the world of online lending. Promising a seamless borrowing experience with fast approvals and transparent costs, Crezu has captured the attention of many. But is Crezu a legitimate option, or should borrowers proceed with caution?

This detailed review will explore Crezu Loan Philippines’ offerings, benefits, drawbacks, and credibility, helping you make an informed decision.

🌟 CREZU Loan Philippines 🌟 1️⃣ Easy application process 2️⃣ Fully online – no paperwork needed 3️⃣ Approval within 24 hours 4️⃣ Transparent costs – no hidden fees 5️⃣ Funds disbursed in just 5 minutes! 💸💸💸 APPLY NOW WITH CREZU! 👇👇👇

What is Crezu Loan? An Overview

Crezu is an online lending platform designed to provide fast, hassle-free credit to Filipinos. With its digital-first approach, Crezu simplifies the loan application process, allowing users to apply, get approved, and receive funds—all online. Here’s what sets Crezu apart:

- Quick Approvals: Loan decisions within 24 hours, with funds disbursed in as fast as 5 minutes.

- User-Friendly Platform: Intuitive website and app for smooth navigation.

- Flexible Options: Loans tailored for personal, business, or educational needs.

- Transparency: No hidden fees, with clear terms and conditions.

Is Crezu Legit? Understanding the Platform’s Credibility

Regulatory Compliance

Crezu operates under the regulations of the Philippine Securities and Exchange Commission (SEC), ensuring compliance with national lending standards. Always verify a lender’s SEC registration to avoid scams.

Customer Feedback

Online reviews about Crezu highlight its efficient service and responsive customer support. However, as with any lender, some borrowers raise concerns about interest rates.

Crezu Loan Products: Tailored for Diverse Needs

Crezu caters to a variety of financial requirements, offering products such as:

- Personal Loans: Ideal for emergencies, home improvements, or debt consolidation. No collateral required.

- Business Loans: Helps entrepreneurs and small businesses cover operational costs, inventory, or expansion plans.

- Educational Loans: Supports students by covering tuition, supplies, and other school-related expenses.

Key Features of Crezu Loans

1. Streamlined Application Process

- 100% Online: Apply via their website or app.

- Minimal Documentation: Upload ID, proof of income, and other basic details.

- Quick Submission: Complete the application in minutes.

2. Fast Disbursement

- Loans are typically approved within 24 hours.

- Disbursal to your bank account can happen in as little as 5 minutes after approval.

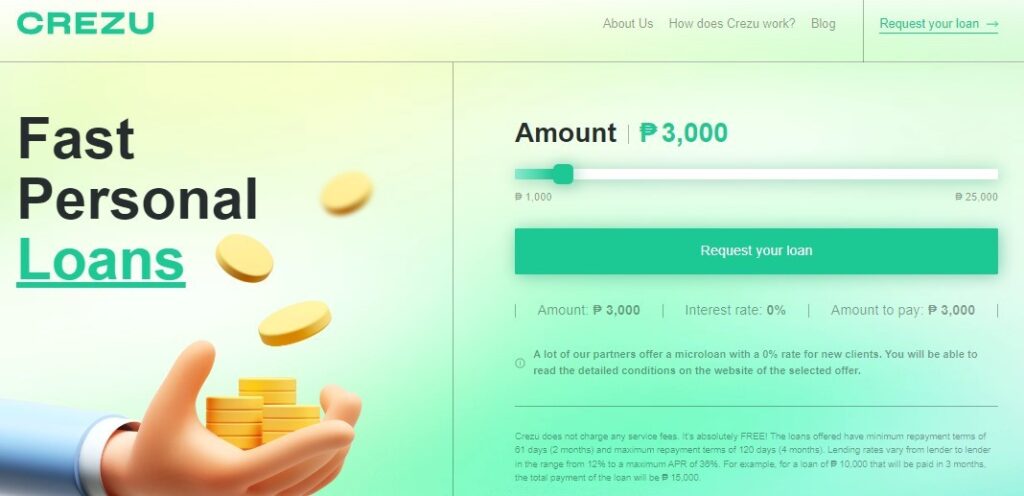

3. Flexible Loan Amounts

- Borrow as little as ₱1,000 or as much as ₱50,000, depending on your eligibility.

4. Competitive Interest Rates

- Rates vary but are disclosed upfront, ensuring cost transparency.

Eligibility and Requirements for Crezu Loans

Basic Eligibility

- Must be a Filipino citizen aged 21 or older.

- Stable source of income.

- Valid government-issued ID and proof of residence.

No Strict Credit Score Requirements

Crezu is lenient with credit scores, making it accessible for individuals with limited or poor credit history.

Employment Verification

Applicants must show proof of consistent income, whether from employment or self-employment.

Step-by-Step Guide: How to Apply for a Crezu Loan

- Visit the Website or App: Start by accessing Crezu’s platform.

- Create an Account: Register with your email and set up a password.

- Complete the Form: Provide personal, employment, and loan details.

- Upload Documents: Submit required ID and proof of income.

- Submit Application: Once submitted, track your application status online.

Interest Rates, Fees, and Repayment Options

Interest Rates

While Crezu offers competitive rates, they may be higher than traditional banks. Rates depend on loan amounts and repayment terms.

Fees

Expect minimal processing fees, which are deducted from the disbursed amount. Crezu is transparent about these charges.

Repayment Terms

Choose repayment periods ranging from a few months to a year. Early repayment is also possible, potentially saving on interest costs.

Pros and Cons of Crezu Loans

Advantages

- Speed: Quick approvals and disbursement.

- Convenience: Fully digital application process.

- Accessibility: No collateral and lenient credit checks.

Disadvantages

- Interest Rates: Higher than traditional bank loans.

- No Physical Branches: Entirely online, which may deter those who prefer face-to-face interactions.

- Over-Borrowing Risk: Easy access to credit might tempt users to borrow beyond their means.

Customer Reviews: Real Experiences

Positive Feedback

Borrowers praise Crezu for its fast approval, easy application, and helpful customer service. Many appreciate its efficiency during emergencies.

Constructive Criticism

Some users report higher-than-expected interest rates, especially for smaller loans. Others mention occasional delays in approval.

Comparing Crezu with Other Lenders

Traditional Banks

Crezu outshines banks in speed and convenience but falls short in offering lower interest rates.

Other Online Platforms

Crezu holds its ground with its transparent policies and user-friendly experience. However, borrowers should compare interest rates and repayment terms across platforms.

Final Verdict: Should You Choose Crezu Loan Philippines?

Crezu stands out as a reliable and efficient online lending platform for Filipinos in need of quick financial assistance. With its fast approvals, digital convenience, and flexible loan options, it offers a compelling alternative to traditional banking.

However, prospective borrowers should consider the following:

- Review loan terms thoroughly.

- Borrow only what you can repay comfortably.

- Compare Crezu’s rates with other platforms to ensure the best deal.

Apply with Crezu Today!

For a hassle-free borrowing experience, visit the Crezu website or download the app now. Access funds quickly and manage your financial needs with ease.

🌟 Top 10 Legit Loan Apps in the Philippines for 2026 🌟 1️⃣ Simple Application Process 2️⃣ 100% Online Transactions 3️⃣ Approval Within 24 Hours 4️⃣ Transparent Fees and Charges 5️⃣ Funds Disbursed in Just 5 Minutes 💰💰 Apply Now using the link below! 👇👇👇