In the digital age, financial services have gone online, and lending platforms are no exception. One such platform gaining popularity in the Philippines is CASHSPACE, which promises quick loans with minimal hassle. But as convenient as it sounds, you might be wondering: Is CASHSPACE legal? Is it trustworthy?

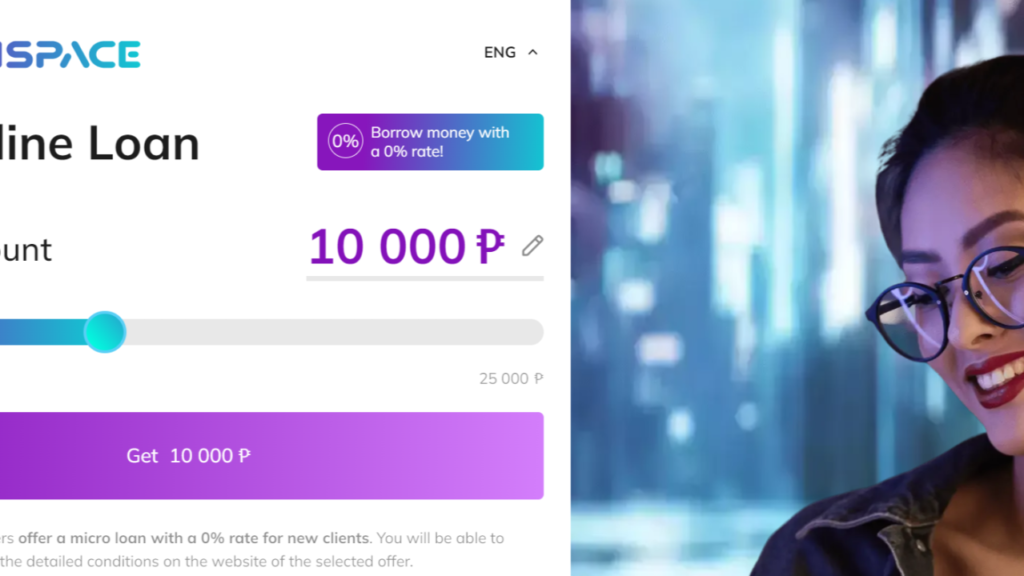

🔥 CASHSPACE – Quick Loans in the Philippines 👉 Fast Approval in Just 15 Minutes 👉 0% Interest for Online Loans 👉 Borrow Up to PHP 25,000 💯💲 CASHSPACE 💲 Get your loan anytime, 24/7!

This article dives deep into everything you need to know about CASHSPACE—from how it works to its pros, cons, and legal standing—so you can make an informed decision.

What Exactly is CASHSPACE?

CASHSPACE isn’t your traditional lender. Instead, it’s an online platform that connects people in need of cash with lending companies. Think of it as a matchmaker for borrowers and lenders.

The platform is designed for speed and accessibility, offering financial solutions to people who might struggle to get loans from banks. Whether you need money for emergencies, unexpected bills, or other urgent expenses, CASHSPACE claims to have you covered.

How Does CASHSPACE Work?

CASHSPACE makes borrowing easy, and here’s how it all goes down:

- Create an Account

You start by signing up on their website, filling out basic information like your name, ID details, and sometimes proof of income. - Apply for a Loan

Once registered, you choose how much you need (up to PHP 25,000) and select a repayment term that works for you. - Get Approved

CASHSPACE connects you to a lender, and if all checks out, you’ll get approved fast—sometimes within just 15 minutes. - Receive the Funds

The loan amount is deposited directly into your bank account, usually within 24 hours. - Repay the Loan

Repayments are made along with interest and fees, through channels like online banking or payment centers.

Is CASHSPACE Legal in the Philippines?

Here’s the short answer: Yes, but there’s more to the story.

Regulations

In the Philippines, online lending platforms fall under the jurisdiction of the Securities and Exchange Commission (SEC). To operate legally, they need to:

- Be registered with the SEC.

- Obtain a Certificate of Authority to Operate as a Lending Company.

- Follow fair lending practices, as mandated by the Lending Company Regulation Act of 2007 (Republic Act No. 9474).

CASHSPACE itself is a registered financial technology platform—not a direct lender. Instead, it acts as a middleman, connecting borrowers to SEC-registered lending companies. If you want to double-check its legal status or its partner lenders, you can visit the SEC website for their list of authorized platforms.

Consumer Protection

The SEC has also introduced rules to protect borrowers from abusive practices, such as sky-high interest rates or unethical debt collection tactics. CASHSPACE’s partner lenders are expected to comply with these guidelines. Still, reports from some users suggest issues with transparency and aggressive collection practices, which are worth noting.

Why Borrow Through CASHSPACE?

Here’s what makes CASHSPACE appealing to many Filipinos:

- Speedy Process

Need cash fast? With approvals in as little as 15 minutes and funds available within 24 hours, CASHSPACE is one of the quickest options out there. - No Collateral Needed

Unlike traditional banks, you don’t need to put up property or assets to secure a loan. - Flexible Options

Borrowers can choose the loan amount and repayment terms that suit their needs and financial situation. - Accessible Anytime, Anywhere

As long as you have a smartphone and an internet connection, you can apply for a loan—no matter where you are.

The Downsides of Using CASHSPACE

Of course, it’s not all smooth sailing. Here are some potential drawbacks to keep in mind:

- High Interest Rates

Convenience comes at a price. Many users report that the interest rates and fees can be steep, especially for short-term loans. - Short Repayment Periods

Most loans on CASHSPACE are short-term, which can make repayments challenging if your budget is tight. - Privacy Concerns

You’ll need to share personal and financial information during registration, and there’s always a risk of data misuse if the platform or its lenders aren’t careful. - Inconsistent Experiences with Partner Lenders

Since CASHSPACE isn’t the direct lender, the quality of your experience depends largely on the lender you’re paired with.

What Are Borrowers Saying About CASHSPACE?

The Good

- Many users praise the fast and hassle-free application process.

- CASHSPACE has been a financial lifesaver for those without access to traditional credit options.

The Bad

- Some borrowers complain about hidden fees that weren’t clear upfront.

- Reports of aggressive debt collection tactics by certain lenders have surfaced, including harassment and even public shaming.

How to Spot Legitimate Online Lending Platforms

If you’re considering CASHSPACE or any other online lender, here’s how to stay safe:

- Verify SEC Registration

Always check the SEC’s website to confirm if the platform and its partner lenders are registered. - Read the Fine Print

Make sure you understand the loan’s terms and conditions, especially the interest rates and fees. - Look for Red Flags

Avoid platforms that pressure you into borrowing or ask for upfront fees. - Check Customer Feedback

Read online reviews to get a sense of how the platform treats its borrowers.

Tips for Borrowing Responsibly

- Only borrow what you absolutely need and can repay.

- Have a clear repayment plan to avoid late fees and penalties.

- Explore alternatives like personal loans from banks or borrowing from family if the terms are more favorable.

Final Thoughts: Is CASHSPACE the Right Choice?

CASHSPACE is legal and operates as a legitimate financial technology platform in the Philippines. It’s a handy tool for anyone who needs quick cash and doesn’t have time for the lengthy processes of traditional banks.

However, convenience comes at a cost. The high interest rates, short repayment terms, and occasional issues with partner lenders mean borrowers need to be cautious.

Before using CASHSPACE, make sure to weigh the pros and cons, read the fine print, and ensure it fits your financial needs. If used wisely, CASHSPACE can be a helpful solution for short-term financial gaps—but it’s not the right fit for everyone.

By being informed and borrowing responsibly, you can make the most of CASHSPACE’s offerings while minimizing risks.

🌟 Top 10 Legit Loan Apps in the Philippines for 2026 🌟 1️⃣ Simple Application Process 2️⃣ 100% Online Transactions 3️⃣ Approval Within 24 Hours 4️⃣ Transparent Fees and Charges 5️⃣ Funds Disbursed in Just 5 Minutes 💰💰 Apply Now using the link below! 👇👇👇