Finding a reliable loan app that offers favorable terms can be challenging, especially for first-time borrowers. However, several online platforms in the Philippines provide 0% interest on initial loans, simplifying the borrowing process and helping you meet your financial needs responsibly. Here’s an in-depth look at the top 10 legitimate online loan apps, their features, and what sets them apart.

🔥 Top Loan Apps in the Philippines 🔥 1️⃣ Simple and hassle-free procedures 2️⃣ Fully online application process 3️⃣ Fast approval within 24 hours 4️⃣ Transparent costs, no hidden charges 5️⃣ Quick disbursement in just 5 minutes 👉 Recommended Apps: ✔ DIGIDO ✔ CASH-EXPRESS ✔ KVIKU ✔ FINBRO ✔ CREZU ✔ LOANONLINE ✔ CASHSPACE ✔ FINMERKADO ✔ PEROLOAN ✔ MONEY CAT ✔ FINLOO Get started today!

1. DIGIDO

Why Choose DIGIDO?

DIGIDO is a highly trusted platform that leverages advanced technology to deliver fast and reliable financial solutions.

- Loan Amounts: ₱2,000 to ₱25,000

- Repayment Terms: 91 to 180 days

- Key Features:

- 0% interest for first-time borrowers

- Quick processing with disbursement within 5 minutes

- 100% online application

This app offers transparency in fees and ensures borrowers have a seamless experience.

🔥🔥🔥 DIGIDO Online Loan App – Philippines 👉 Quick Loans 100% Online 👉 Receive up to ₱10,000.00 in just 4 minutes directly to your bank account! 💯 Fast, Reliable, and Convenient 💲 DIGIDO – Your trusted loan partner. Get a loan now! 💲

2. CASH-EXPRESS

Why Choose CASH-EXPRESS?

Known for its quick approval and flexible terms, CASH-EXPRESS caters to urgent financial needs with ease.

- Loan Amounts: ₱1,000 to ₱10,000

- Repayment Terms: 5 to 30 days

- Key Features:

- 0% interest on initial loans

- Approval in 15 minutes

- User-friendly and efficient application process

This platform is perfect for small, short-term financial requirements.

🔥 CASH-EXPRESS – Fast Online Loans 🔥 👉 Quick approval in just 15 minutes 👉 100% online application 👉 Get a loan of up to PHP 20,000 💯 💲 CASH-EXPRESS – Easy, fast, and reliable. Apply Now! 💲

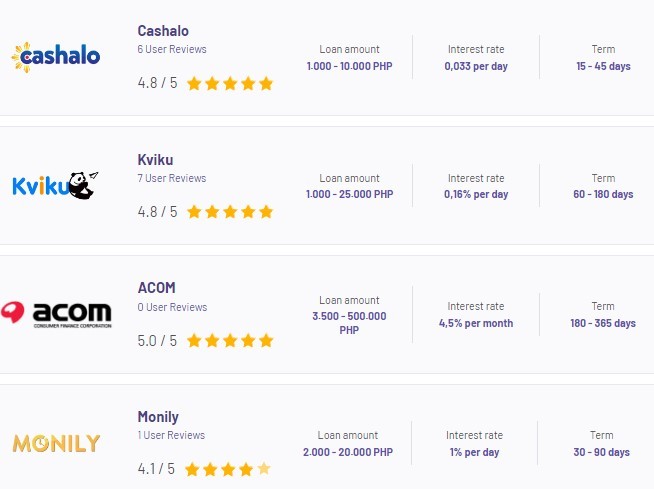

3. KVIKU

Why Choose KVIKU?

KVIKU is a versatile loan app offering a broad range of financial solutions tailored to your needs.

- Loan Amounts: ₱1,000 to ₱50,000

- Repayment Terms: Up to 180 days

- Key Features:

- 0% interest for new borrowers

- Fully online application with disbursement in minutes

- Transparent terms and low fees

🔥🔥🔥 KVIKU Philippines – Fast Online Loans 🔥 👉 Quick online loans 👉 Loan amount up to PHP 25,000 for up to 180 days 👉 Funds disbursed in just 5 minutes 💲 KVIKU – Simple, fast, and reliable. Get a loan now! 💲

4. FINBRO

Why Choose FINBRO?

FINBRO prioritizes a seamless and secure borrowing experience for Filipinos.

- Loan Amounts: ₱1,000 to ₱20,000

- Repayment Terms: Up to 90 days

- Key Features:

- Interest-free loans for first-time users

- Secure platform with data protection

- Fast processing and disbursement

🔥 FINBRO App – Online Loans in the Philippines 🔥 👉 Simple procedures 👉 100% online application 👉 24-hour approval 👉 Transparent costs 👉 Funds disbursed in just 5 minutes 💲 FINBRO – Fast, reliable, and available 24/7. Get a loan now! 💲

5. CREZU

Why Choose CREZU?

Designed for quick and easy borrowing, CREZU is an excellent choice for first-time borrowers.

- Loan Amounts: ₱1,000 to ₱10,000

- Repayment Terms: 7 to 30 days

- Key Features:

- 0% interest for new users

- Transparent fees with no hidden charges

- Approval within minutes

🔥 CREZU – Quick Online Loans in the Philippines 🔥 🔸 0% interest and fees 🔸 Available for those with bad credit history 🔸 No need for payslips or proofs of billing 💲 CREZU – Fast, simple, and accessible for everyone. Get a loan now! 💲

6. LOANONLINE

Why Choose LOANONLINE?

With competitive rates and secure features, LOANONLINE is a dependable option for managing short-term financial challenges.

- Loan Amounts: ₱1,000 to ₱20,000

- Repayment Terms: Up to 90 days

- Key Features:

- 0% interest on first loans

- Fast application and disbursement

- Secure platform for user privacy

🔥 LOANONLINE – Fast Online Loans in the Philippines 🔥 👉 Quick loan approval in just 2 minutes 👉 0% interest on loans 👉 Loan amount up to ₱25,000 👉 Receive quick feedback on your application 💯 💲 LOANONLINE – Fast, easy, and hassle-free. Get a loan now! 💲

7. CASHSPACE

Why Choose CASHSPACE?

CASHSPACE combines quick approvals with flexible terms, making it ideal for urgent financial needs.

- Loan Amounts: ₱1,000 to ₱20,000

- Repayment Terms: Up to 30 days

- Key Features:

- 0% interest for first-time borrowers

- Approval within 15 minutes

- Simple and transparent loan terms

🔥 CASHSPACE – Fast Online Loans in the Philippines 🔥 👉 Quick loan approval in just 15 minutes 👉 0% interest on loans 👉 Loan amount up to PHP 25,000 💯 💲 CASHSPACE – Available 24/7, fast, and reliable. Get a loan now! 💲

8. FINMERKADO

Why Choose FINMERKADO?

FINMERKADO is tailored for borrowers looking for larger amounts and longer repayment terms.

- Loan Amounts: ₱5,000 to ₱50,000

- Repayment Terms: Up to 120 days

- Key Features:

- 0% interest on initial loans

- Transparent fees and terms

- Easy-to-use online application

🔥 FINMERKADO Loan App – Philippines 🔥 👉 Quick loan approval in just 2 minutes 👉 100% online application 👉 Compare and apply for loan offers at your convenience, 24/7 💲 FINMERKADO – Fast, simple, and accessible. Apply now! 💲

9. PEROLOAN

Why Choose PEROLOAN?

PEROLOAN is known for its secure platform and flexible repayment terms, ideal for medium-sized loans.

- Loan Amounts: ₱5,000 to ₱50,000

- Repayment Terms: Up to 180 days

- Key Features:

- 0% interest for first-time borrowers

- Quick approval and processing

- Flexible repayment options

🔥🔥🔥 PEROLOAN – Quick Loans in the Philippines 🔥 💲 Find a loan in just 5 minutes 💲 Low interest rates 💲 Loan amount up to ₱25,000 💲 Fast approval and money transfer 💯 💲 PEROLOAN – Easy, fast, and reliable. Apply now! 💲

10. MONEY CAT

Why Choose MONEY CAT?

MONEY CAT offers a user-friendly experience with an emphasis on quick disbursements.

- Loan Amounts: ₱1,000 to ₱20,000

- Repayment Terms: Up to 90 days

- Key Features:

- No interest on first loans

- Fast application and fund release

- Secure and reliable service

🔥🔥🔥 MONEY CAT – Instant Cash Loan Online 🔥 👉 Instant cash loan approval 👉 Loan amount up to PHP 20,000 👉 Loan term up to 180 days 👉 Funds disbursed in just 5 minutes 👉 First loan for FREE 💯 💲 MONEY CAT – Fast, easy, and convenient. Apply now! 💲

Choosing the Right Loan App

When selecting a loan app, always verify its legitimacy by checking if it’s regulated by the Bangko Sentral ng Pilipinas (BSP). Compare terms, ensure transparency, and only borrow what you can comfortably repay. By leveraging these apps responsibly, you can address your financial needs while building a positive credit history.

Empower your financial journey today by choosing a reliable loan app!

🌟 Top 10 Legit Loan Apps in the Philippines for 2025 🌟 1️⃣ Simple Application Process 2️⃣ 100% Online Transactions 3️⃣ Approval Within 24 Hours 4️⃣ Transparent Fees and Charges 5️⃣ Funds Disbursed in Just 5 Minutes 💰💰 Apply Now using the link below! 👇👇👇