Access to quick and reliable financial solutions has become a necessity for many Filipinos. Fast cash loan apps have emerged as a practical option, offering convenience and speed for those facing urgent financial needs. From medical emergencies to unexpected bills, these apps provide a lifeline without the hassle of traditional banking processes. With the growing […]

Tag Archives: loan app

The financial services sector in the Philippines has evolved dramatically in recent years, thanks to the rise of digital platforms. These advancements have made loan access faster, easier, and more efficient for Filipinos. Among these emerging platforms is Crezu, a service that markets itself as a fast and hassle-free loan matching solution. But the question […]

The rapid growth of online lending in the Philippines has provided Filipinos with easy access to financial assistance through mobile apps. One such platform that has gained attention is the Coco Loan App. However, with the increasing number of digital lending services, concerns about legality, security, and transparency arise. This article provides an in-depth review […]

Financial needs can arise unexpectedly, making it crucial for individuals to have access to quick and convenient loan options. With advancements in technology, online loan apps have become increasingly popular, particularly in the Philippines, where borrowers can secure funds with minimal effort. As approaches, the demand for online loan apps offering 30-day repayment periods is […]

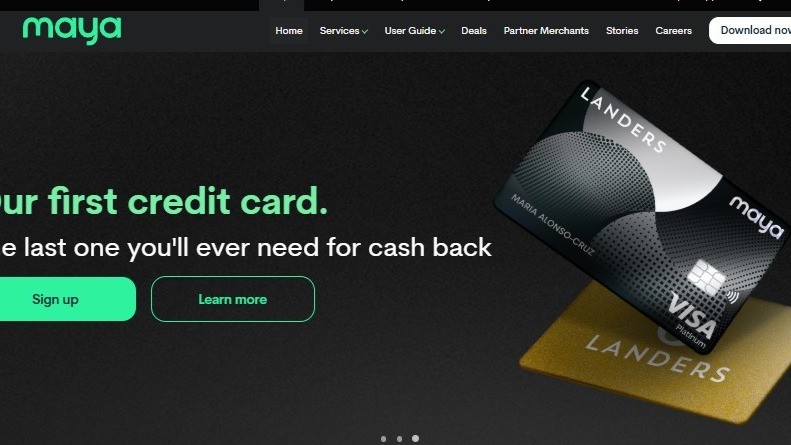

The digital revolution in the Philippines has transformed the financial landscape, making it easier for people to manage their finances, make payments, and even secure loans, all from the convenience of their smartphones. Among the leading platforms driving this change is Maya (formerly known as PayMaya). Since its rebranding in April 2022, Maya has evolved […]

Home Credit Philippines is a leading consumer finance company offering personal loans, gadget financing, and installment plans to millions of Filipinos. As digital lending becomes more popular, many potential borrowers ask: Is the Home Credit Loan App legal? How does it work? And is it safe to use in ? In this in-depth review, we’ll […]

The demand for quick and hassle-free loans has skyrocketed in the Philippines, leading to the rise of digital lending apps. Among these is StarLoan, a platform that claims to offer instant cash with minimal requirements. However, the big question remains: Is StarLoan legal in the Philippines? This in-depth review of StarLoan in will examine its […]

Cashwagon has become a well-known online lending platform in the Philippines, offering quick and convenient loans to those in urgent financial need. However, many Filipinos still question its legality and reliability. In this in-depth review, we will explore whether Cashwagon is legal in the Philippines in , analyze its services, discuss potential risks, and suggest […]

The rise of fintech apps in the Philippines has transformed the way Filipinos access financial services. Borrowing money, once a time-consuming process filled with paperwork, is now just a few taps away. Whether you’re seeking funds for a business venture, emergency expenses, or personal needs, loan apps offer a convenient and fast solution. In this […]

Looking for a reliable online loan app in the Philippines? Finbro is gaining traction among Filipinos as a fast and convenient financial solution. With its promise of 24-hour approval and disbursement within minutes, it’s no surprise that many are curious about its legitimacy. This article dives into the details of Finbro, evaluates its services, and […]