The financial landscape in the Philippines has undergone a remarkable transformation in recent years, with digital banking platforms playing a pivotal role in driving financial inclusion and accessibility. Among these platforms, the Maya Loan App has emerged as a standout player, capturing the attention of millions of Filipinos seeking convenient and reliable financial solutions. As […]

Tag Archives: loan app

Looking for a quick and hassle-free way to secure a loan in the Philippines? MoneyCat might just be the solution you’re seeking. Offering fast approvals, minimal documentation, and up to PHP 20,000 in cash loans, this online lending platform has gained popularity among Filipinos. But is MoneyCat legal? And is it the right choice for […]

As financial technology continues to reshape the lending landscape, platforms like Binixo Philippines have become a popular solution for individuals seeking quick and hassle-free loans. With the rising demand for accessible credit, Binixo stands out for its streamlined processes and broad network of lending partners. However, questions about its legality, reliability, and overall user experience […]

Accessing financial assistance has never been easier, thanks to the rise of digital loan applications. These platforms offer borrowers a seamless way to secure funds at competitive interest rates with extended repayment terms, all from their smartphones. Whether you need money for an emergency, business investment, or personal expenses, choosing the right loan app can […]

As digital financial services continue to reshape the lending industry in the Philippines, platforms like GCredit have emerged as a go-to solution for those seeking quick and convenient credit access. Integrated within the widely used GCash app, GCredit offers a flexible credit line that enables users to make purchases and pay bills seamlessly. But is […]

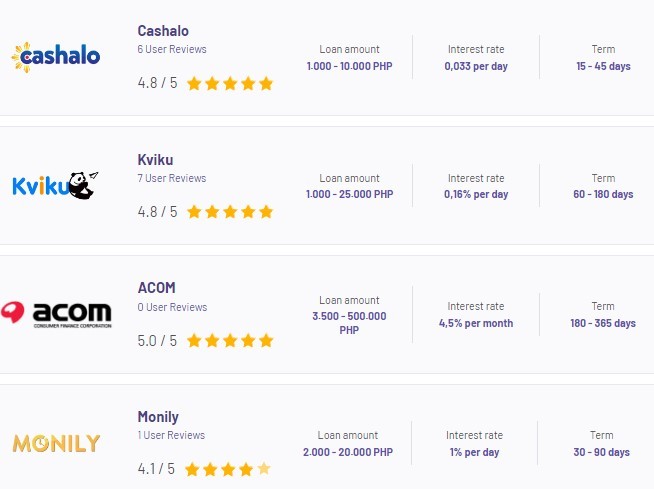

Finding a reliable loan app that offers favorable terms can be challenging, especially for first-time borrowers. However, several online platforms in the Philippines provide 0% interest on initial loans, simplifying the borrowing process and helping you meet your financial needs responsibly. Here’s an in-depth look at the top 10 legitimate online loan apps, their features, […]

🔥 Top Online Loan Apps in the Philippines 🔥 Here’s a list of the best loan apps for fast and reliable cash: 1️⃣ Simple Procedures 2️⃣ 100% Online Application 3️⃣ 24-Hour Approval 4️⃣ Transparent Costs 5️⃣ Funds Disbursed in Just 5 Minutes 👉 Recommended Apps: ✔ DIGIDO ✔ CASH-EXPRESS ✔ KVIKU ✔ FINBRO ✔ CREZU […]

If you’ve ever wondered, “Which loan app has the lowest interest rate?” you’re not alone. The rise of digital lending platforms has made it easier than ever to borrow money. But with so many options available, how do you know which app is legitimate and offers the best deal? This guide breaks down everything you […]

The growing demand for quick and accessible financial solutions has paved the way for numerous online lending platforms in the Philippines. Among these, the SALPa Loan App has emerged as a prominent player. But how does it measure up in terms of legality, user experience, and overall reliability? In this detailed review, we’ll explore everything […]

In the dynamic landscape of financial services, online loan apps are revolutionizing how Filipinos access funding. As we step into , these digital platforms offer an efficient way to secure loans with long-term payment options tailored to meet diverse financial needs. The convenience of applying from anywhere at any time, combined with quick approval processes […]