🔥 PeroLoan Philippines: 💲 Get a loan in as little as 5 minutes 💲 Low-interest rates 💲 Borrow up to ₱25,000 💲 Fast approval and instant fund transfer! 💯💲 Apply Now! 💲 In recent years, online lending platforms have surged in popularity across the Philippines, offering fast and convenient access to funds for Filipinos in […]

Tag Archives: loan review

The digital revolution in the Philippines has transformed the financial landscape, making it easier for people to manage their finances, make payments, and even secure loans, all from the convenience of their smartphones. Among the leading platforms driving this change is Maya (formerly known as PayMaya). Since its rebranding in April 2022, Maya has evolved […]

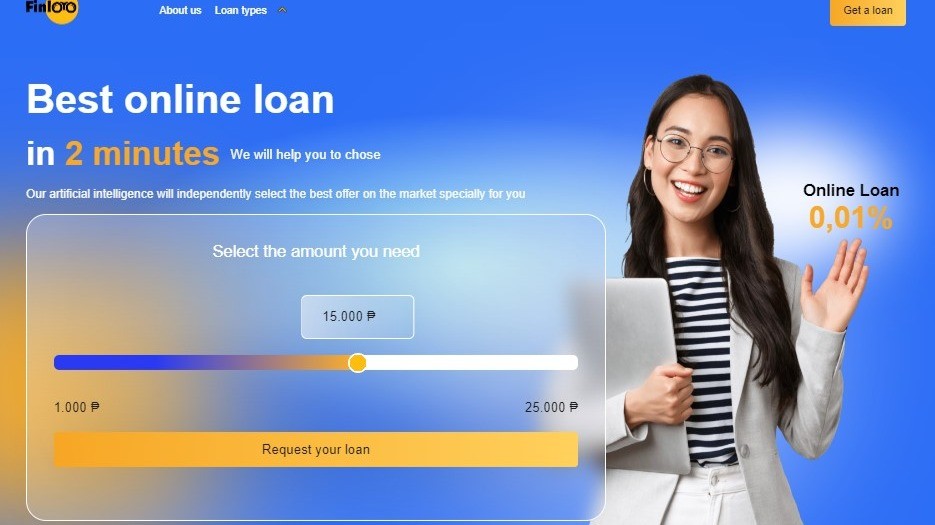

Digital lending platforms have revolutionized how people access financial assistance, particularly in regions like the Philippines where traditional banking services may not reach everyone. Among these platforms, FINLOO stands out for its user-friendly approach and quick loan disbursement. However, as these services grow, the question arises: Is FINLOO legal? 🔥 FINLOO Online Loans Philippines 👉 […]

The online lending industry in the Philippines continues to evolve in , making it easier than ever for Filipinos to access quick and convenient financial solutions. One of the most trusted platforms for digital transactions is GCash, which offers various financial services, including GLoan—a fast, secure, and hassle-free lending option. This detailed review explores GLoan’s legitimacy, […]

Home Credit Philippines is a leading consumer finance company offering personal loans, gadget financing, and installment plans to millions of Filipinos. As digital lending becomes more popular, many potential borrowers ask: Is the Home Credit Loan App legal? How does it work? And is it safe to use in ? In this in-depth review, we’ll […]

The demand for quick and hassle-free loans has skyrocketed in the Philippines, leading to the rise of digital lending apps. Among these is StarLoan, a platform that claims to offer instant cash with minimal requirements. However, the big question remains: Is StarLoan legal in the Philippines? This in-depth review of StarLoan in will examine its […]

Cashwagon has become a well-known online lending platform in the Philippines, offering quick and convenient loans to those in urgent financial need. However, many Filipinos still question its legality and reliability. In this in-depth review, we will explore whether Cashwagon is legal in the Philippines in , analyze its services, discuss potential risks, and suggest […]

The financial landscape in the Philippines has undergone a remarkable transformation in recent years, with digital banking platforms playing a pivotal role in driving financial inclusion and accessibility. Among these platforms, the Maya Loan App has emerged as a standout player, capturing the attention of millions of Filipinos seeking convenient and reliable financial solutions. As […]

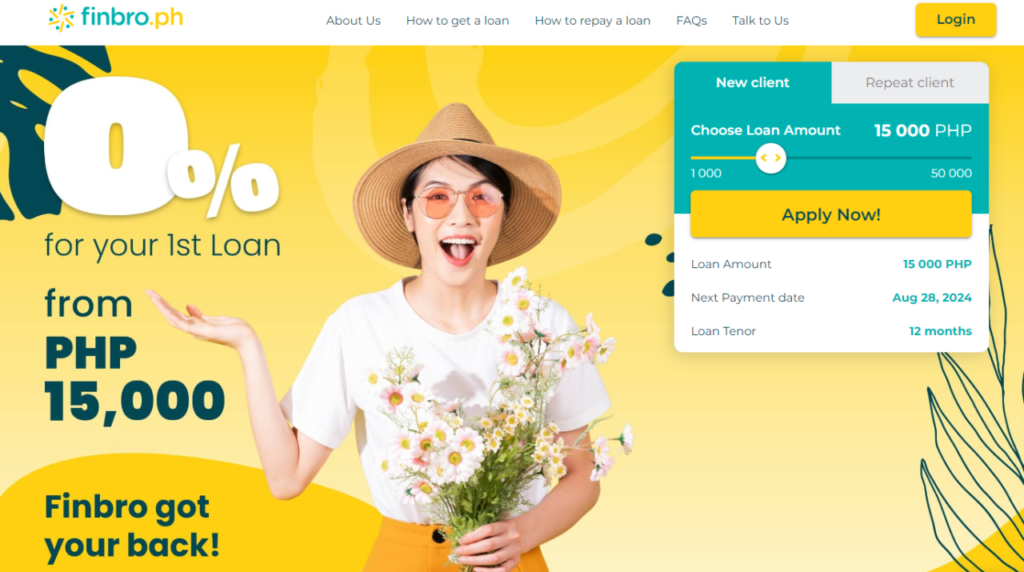

As the digital finance landscape continues to expand, Filipino investors are looking for platforms that provide reliable access to global financial markets. One such platform, FINBRO, has quickly gained attention in the Philippines. But as we step into , is FINBRO a legitimate and trustworthy option for Filipino investors? In this comprehensive review, we’ll dive […]

As financial technology continues to reshape the lending landscape, platforms like Binixo Philippines have become a popular solution for individuals seeking quick and hassle-free loans. With the rising demand for accessible credit, Binixo stands out for its streamlined processes and broad network of lending partners. However, questions about its legality, reliability, and overall user experience […]