Finding a loan online has never been more convenient. With the rise of digital lending platforms, borrowers can access funds quickly with minimal paperwork and hassle. However, not all loans are equally easy to obtain. Some lenders have strict eligibility criteria, while others offer fast approval with minimal credit checks. If you need quick cash […]

Tag Archives: online loan

Online loan apps in the Philippines have become a go-to option for quick access to cash – whether for emergency expenses, small business capital, or personal needs. But while convenience is a big draw, the risks are just as real. Unlicensed loan apps have been reported to harass borrowers, misuse private data, and charge hidden […]

Ayuda Philippines has emerged as a transformative platform, bridging the gap between individuals in need and generous donors, non-governmental organizations (NGOs), and government assistance programs. With its growing popularity comes a critical question: is Ayuda Philippines legal and trustworthy? This in-depth review delves into its operations, compliance with legal standards, and the user experience in […]

As digital finance transforms the way people access financial services, Tala has emerged as a game-changer, especially in the Philippines. With millions still unbanked or underserved by traditional financial systems, Tala provides a lifeline for individuals needing small, short-term loans. However, one pressing question often arises: Is Tala legal in the Philippines? 💥 Online Legit […]

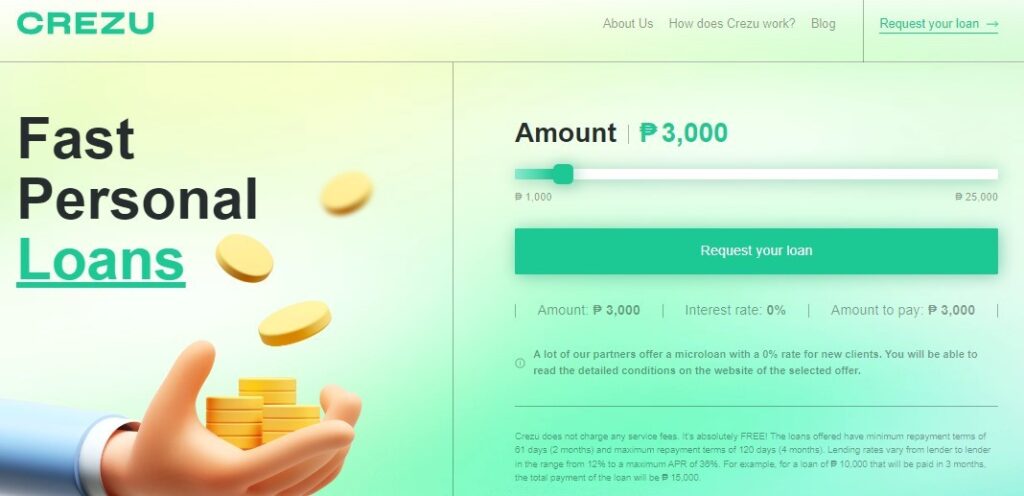

Navigating the financial landscape in the Philippines can be overwhelming, especially when you need quick, reliable credit. Enter Crezu, a growing name in the world of online lending. Promising a seamless borrowing experience with fast approvals and transparent costs, Crezu has captured the attention of many. But is Crezu a legitimate option, or should borrowers […]

In an era where digital financial solutions are reshaping the Philippine lending landscape, FinmerKado has emerged as a notable player in the online lending space. This comprehensive review examines FinmerKado’s legitimacy, features, and performance in , helping you make an informed decision about this digital lending platform. 🔥 FINMERKADO Loan App Philippines: 👉 Quick Loan […]

🔥 PeroLoan Philippines: 💲 Get a loan in as little as 5 minutes 💲 Low-interest rates 💲 Borrow up to ₱25,000 💲 Fast approval and instant fund transfer! 💯💲 Apply Now! 💲 In recent years, online lending platforms have surged in popularity across the Philippines, offering fast and convenient access to funds for Filipinos in […]

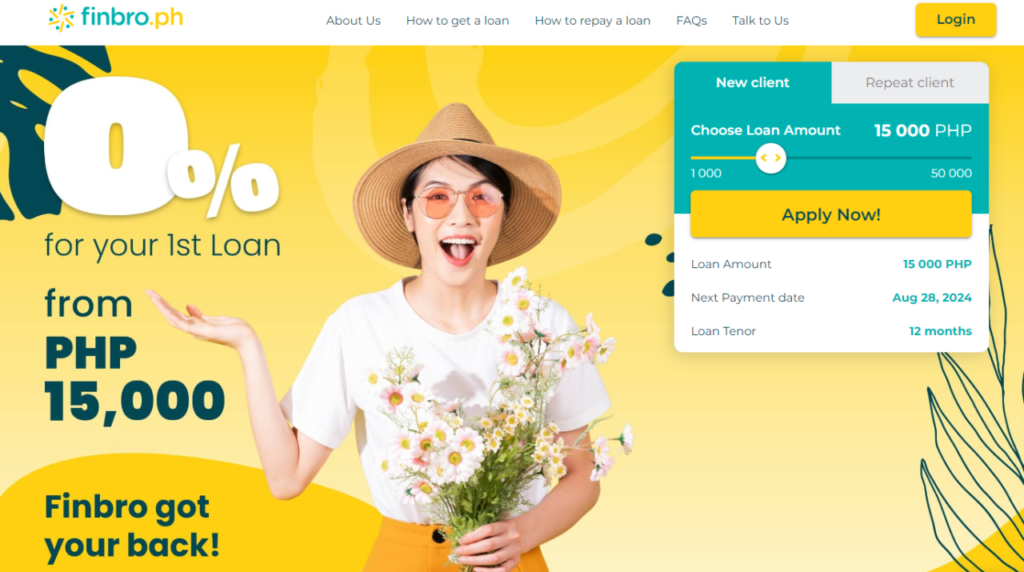

As the digital finance landscape continues to expand, Filipino investors are looking for platforms that provide reliable access to global financial markets. One such platform, FINBRO, has quickly gained attention in the Philippines. But as we step into , is FINBRO a legitimate and trustworthy option for Filipino investors? In this comprehensive review, we’ll dive […]

Looking for a quick and hassle-free way to secure a loan in the Philippines? MoneyCat might just be the solution you’re seeking. Offering fast approvals, minimal documentation, and up to PHP 20,000 in cash loans, this online lending platform has gained popularity among Filipinos. But is MoneyCat legal? And is it the right choice for […]

🌟 Discover the Top Online Lenders for Fast Loans in the Philippines: 🚀 DIGIDO ✔ CASH-EXPRESS ✔ KVIKU ✔ FINBRO ✔ CREZU ✔ LOANONLINE ✔ CASHSPACE ✔ FINMERKADO ✔ PEROLOAN ✔ MONEY CAT ✔ FINLOO ✔ Quick Financial Solutions Without Credit Checks Emergencies don’t wait, and neither should your access to cash. Whether you’re dealing […]